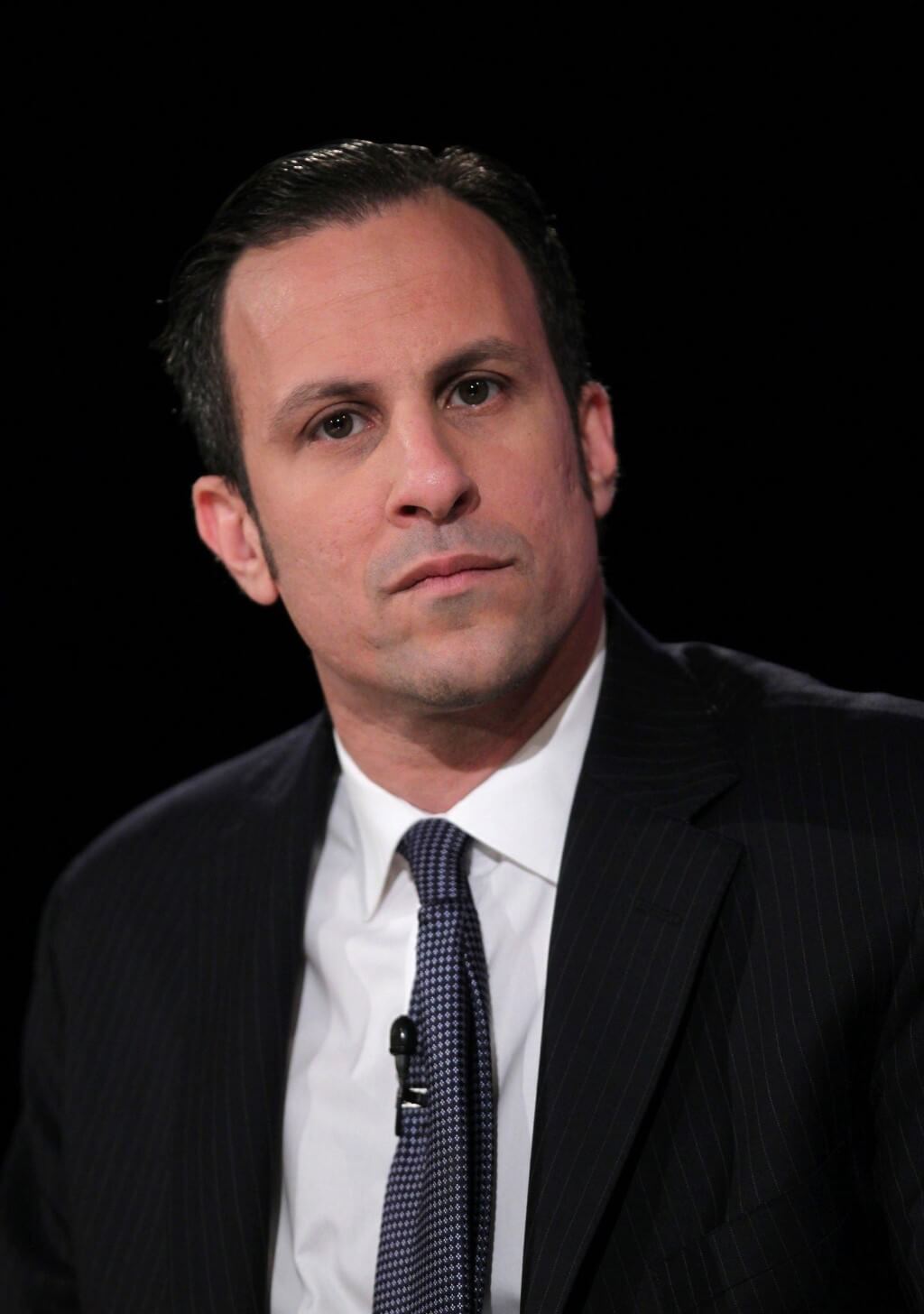

Greg Holden Lippmann is an American hedge fund manager, and one of the key figures in Michael Lewis’ book ‘The Big Short’.

His character might be described by some movie fans as “morally questionable” or the “quintessential Loud-mouthed Wall Street bro.”

Maybe he is the guy that talks about how much money he makes—but how much money does he actually make?

And what else do we know about him? Read on to find out.

Who is Greg Lippmann?

Greg Lippmann is an American hedge fund manager and one of the key figures in Michael Lewis looks book.

He is recognized to be hardworking who worked for Deutsche Bank as the global head of asset-backed securities trading until he left later on in 2010 that was in April.

Lippmann is also the cofounder and investment chief of LibreMax, an $8 billion asset manager specializing in structured products.

Greg Lippmann is an icon in the world of Wall Street.

A hedge fund manager and finance whizz kid, Greg Lippmann was even a key character in Michael Lewis 2010 bestselling book, The Big Short: Inside the Doomsday Machine.

Greg Lippmann Age and Birthplace

He was born on 30th January 1969, and he is 55 years old as of 2023.

Greg Lippmann is the son of Susan Lippmann, a business manager at Purchase College, and Thomas J. Lippmann, the retired owner of the DBL Operating Corporation.

It is a real estate investment and management business in New York, both in Scarsdale, New York.

Greg Lippmann Education

Greg Lippmann earned a bachelor’s degree in economics from the University of Pennsylvania in 1991.

Greg is a true-blue New Yorker—both Thomas and Susan are from Scarsdale.

Despite his mom’s links to Purchase College, Lippmann enrolled at the University of Pennsylvania in the late 80’s—he graduated magna cum laude with a bachelor’s degree in economics and a minor in English in 1991.

From there, he was ready to break into the world of finance—something he’d been passionate about since his teen years.

Greg Lippmann Career

Lippmann worked for Deutsche Bank, as global head of asset-backed securities trading, until he left in April 2010, and was succeeded by Pius Sprenger.

In February 2010, Lippmann announced that he would be joining a hedge fund started by Fred Brettschneider. Fred was formerly Deutsche Bank’s head of global markets.

Lippmann co-founded LibreMax Partners with Brettschneider, and is its Chief Investment Officer and Portfolio Manager.

In May 2016, Bloomberg LP reported that Lippmann was working with Promise Financial on a wedding loans business.

The Journey to Wall Street

Greg hit the ground running fresh out of college by joining Credit Suisse in 1991. He worked his way up to Director and Head of ABS/MBS Subordinate and CDO trading.

Next it was on to financial giant, Deutsche Bank. He would progress from his role as a trader of non-investment grade ABS and RMBS securities to Global Head of ABS and CDO trading in 2003.

He added non-agency MBS to his resume in 2008. His career was progressing at a stellar rate—and Lippmann was ready to make one of his biggest moves so far.

The Big Short

In early 2006, Lippmann had a theory. He began advising clients and colleagues that it was time to short the subprime mortgage market.

Lippmann was one of the high-profile bond traders who was able to read the writing on the wall of the subprime mortgage lending market and capitalize on it.

He made a major profit on the subprime mortgage lending market and collateralized debt obligations—also known as CDOs.

In the early 2000’s, millions of people were sold mortgages on homes they could not realistically afford.

Investors bought up the CDOs built on these mortgages, and when people failed to pay back their loans it triggered the biggest economic crash since the Great Depression.

It left a few savvy investors—those who purchased insurance policies, like Greg Lippmann—very, very rich.

And millions of Americans were left jobless. The move made Deutsche Bank almost $2 billion, and inspired Michael Lewis to pen The Big Short.

The Big Short: Inside the Doomsday Machine, is Michael Lewis’s non-fiction book.

Released on March 15, 2010, it spent 28 weeks on the New York Times best-seller list, and inspired the 2015 blockbuster classic.

Hyped Hedge Fund Libre Max

Deutsche Bank’s CDO star teamed up with another Deutsche Bank alum—Fred Brettschneider—at a new hedge fund in 2007.

Libre Max—which Lippmann and Brettschneider said loosely translates to “free with no restrictions”—was one of the most hyped hedge funds of the year. But some investors were curious as to whether Lippmann could achieve the same level of success that he’d enjoyed at Deutsche Bank.

They needn’t have worried. Libre Max Capital was listed as one of 2011’s hedge fund rising stars and was holding upwards of $650 million in assets by 2012.

In May of 2016, Lippmann expanded into the lucrative world of wedding loans when he teamed up with Promise Financial.

Greg Lippmann Spouse

Greg Lippmann married his long-time girlfriend and renowned doctor, Kimberly Lee Duckworth, when Greg Lippmann was 33 years old.

Kimberly Lee Duckworth is the daughter of Ingrid D. Bellemère of Las Vegas and Stephen M. Duckworth of Naples, Florida.

Their wedding took place on December 14, 2002, at the 200 Fifth Club in New York City. The ceremony was officiated by Rabbi Stephen A. Klein.

Greg Lippmann Net Worth

Lippmann earned most of his wealth from co-founding and managing LibreMax and working for Deutsche Bank.

LibreMax has over $8.4 billion under management. Therefore, Greg Lippmann has an estimated net worth of over $100 million.

Lippmann is known for getting rich shorting the housing market before the 2008 crash.

Conclusion

Greg Lippmann is one of the most extraordinary bankers in America. As motivating by enthusiasm, he has accomplished a lot of progress in the banking business.

He is a tycoon and easily manages the cost of an extravagant way of life for him as well as his family. Furthermore, he is cheerfully wedded, and his marriage has been stable.

The banker is usually a risk-taker. With high-risk exchanging, he has occupied and has wound up acquiring enormous pay inside brief periods.

Hope you enjoyed this article. Share with us your valuable feedback in the comments section below.

We will soon be back with a new and interesting article.

Next Read: Mercy Mogase Biography